Part 2 – Understanding Wealth & Investment Fundamentals

By Robert Vallera CCIM

• How and why your wealth should be your employee.

• What can the broader investment markets teach us about real estate investing?

For decades, I’ve had investors ask me to recommend a book or two that will help them with their real estate investments. In my most recent post I described the importance of obtaining a broad body of knowledge in the realms of finance, investments and economics. The investor who possesses specialized real estate knowledge but lacks this general knowledge might build a small fortune in an up-cycle only to lose it all in the ensuring recession.

Let me also mention what has been excluded from my list. None of the books offer simplistic formulas that set you up to quickly build wealth during a bull market… and lose it all in the ensuing down-cycle. None offer the fiction of high returns for little risk. I didn’t write any of the books, and I’m not selling accompanying audiotapes, seminars, or workshops. My qualifications for making the following recommendations appear on my Professional Profile.

Understanding Wealth

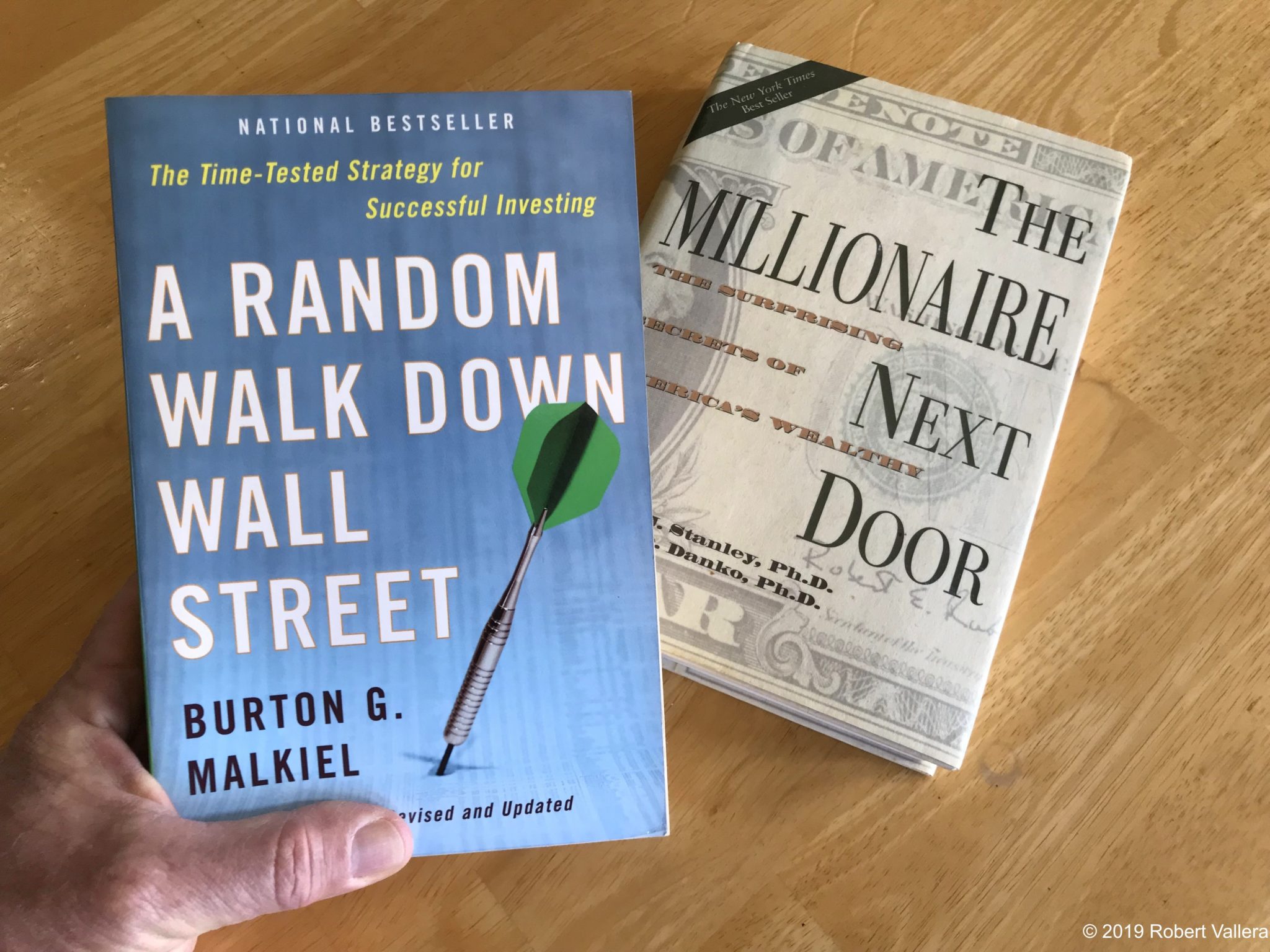

Without an understanding of the concepts in these first two books, your ship is sunk before you even leave the dock. They teach a simple story that most people miss, and as a result, spend the bulk of their lives working for money. Wouldn’t it be a lot easier to read these two books, and instead then spend the rest of your life with your money working for you? If you have children in their late teens or older, do them a huge favor. Beg or bribe them if you have to, but get them to read these books as well.

The Millionaire Next Door: The Surprising Secrets of America’s Wealthy, by Thomas J. Stanley & William D. Danko

This easy read separates the reality of wealth from the false image so prevalent in our society. The authors reveal that many of the people who appear to be affluent are merely spendthrift consumers, best characterized as having high incomes, but low net worth. You’ll enjoy their investigation of the surprising traits of those who have achieved a high net worth and explanation of how it is most frequently accomplished.

Rich Dad, Poor Dad, by Robert Kiyosaki

This is the only lightweight book on the list. It’s a fun read that you can blow through in a weekend, and it’s well worth your time to do so. If you enjoy this book, an excellent follow-up is Kiyosaki’s Retire Young, Retire Rich. I think Kiyosaki gives some poor advice in a few of his later books, but he’s right on the money in these two. As a bonus, his writing style will help to motivate you into action.

Investment Fundamentals

These two volumes delve into the nuts and bolts of investing and they both emphasize the securities markets. Yes, you read that correctly, securities, as in stocks and bonds. A carefully constructed securities portfolio can serve as a lower risk and less management intensive investment alternative to real estate. Of course, risk and return are related, and that is why so many investors favor real estate. However, it’s difficult to fully understand the proper role of real estate in an investment portfolio without understanding alternative investments. In addition, these books will expose you to critical concepts and controversy over the efficiency and predictability of investment markets.

The Four Pillars of Investing: Lessons for Building a Winning Portfolio, by William Bernstein

This is a superb introduction to investment fundamentals that will help you tie together the many different facets of the investment world. The first eight chapters examine the theory, history, and psychology of investing. The following three chapters closely scrutinize the investment industry. The book closes with three chapters on investment and portfolio strategy.

A Random Walk Down Wall Street: The Time Tested Strategy For Successful Investing, by Burton G. Malkiel

Originally written in 1973, the 12th edition of this book is now in print! Malkiel provides an in-depth examination of various justifications for the valuation of securities, and how these have changed over the decades, through market crashes and periods of irrational exuberance. Do you think these concepts might ever relate to the valuation, and perhaps temporary mis-valuation of investment real estate?

In Part 3 we will review some of the books that explain the market dynamics that have allowed some of my investor clients to build portfolios ranging from hundreds to thousands of apartment units.

Leave a Reply