Applying Timeless Principles From Past Real Estate Rodeos

But First, A Personal Note …

My family has been receiving front line reports on the pandemic from our daughter Jacqueline, an ICU nurse in Chicago who is pictured above wearing her home-made protective mask, and my sister Cris, an MD treating patients at UCLA Medical Center. Their stories are personal, emotional, and in some cases tragic. As you can imagine, they touch us at a much deeper level than any media reports.

So, here we were, sheltered-in-place at home, watching paramedics and a fire truck respond to a medical emergency at our neighbor’s house last week. Their otherwise healthy adult son was feverish and had passed out. He was transported to Scripps Hospital for treatment and, fortunately, released to home quarantine by the end of the day. I’ve also heard from a middle-age client residing in northern Italy who has now recovered from COVID. He was fit and trim at the onset of the illness. He really didn’t need to lose any of the 14 pounds that the effects of the virus stripped from his frame. These episodes bring home the ubiquity and seriousness of the COVID threat.

Four Decades of Real Estate Rodeos

Aside from a brief summary about the pandemic’s impact on the multi-family market that I wrote for Voit Real Estate’s market report, I’ve yet to comment online. The situation has been so fluid that even the most intelligent comments become rapidly outdated.

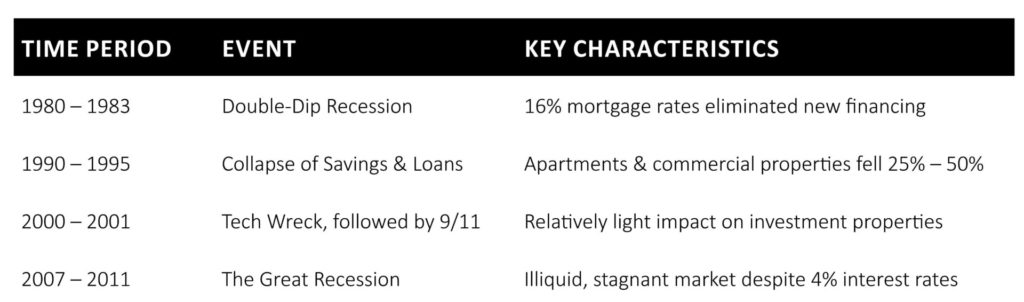

However, this isn’t my first rodeo, i.e., market disruption, nor yours if you rode out the Great Recession. While every market disruption is truly unique, they provide lessons that can be applied to help you navigate the business and investment environment resulting from the current pandemic. This summary will help you understand some of the wild variations in prior market disruptions.

If you’re going to be a successful real estate investor who builds a productive asset base and keeps it for the long run, you need to learn how to ride the bucking bronco of market cycles.

Timeless Principles For Rodeo Riders

1st: Inspect Your Horse(s)

As a real estate investor, you will need to be have a firm grasp on your existing property operations. You can obtain this by performing sensitivity analysis on your operating pro formas. Invest the time to quantify how much vacancy and/or rent reduction your existing investments can absorb without lapsing into negative cash flow if vacancies rise and rents decline.

2nd: Anticipate The Weather

It’s sad to see the damage quickly compounding within our formerly robust economy from the now-necessary shelter-in-place orders. Until large scale anti-body testing and/or effective vaccination becomes available, it’s difficult to determine the proportion of idled and under-employed workers who will be able to fully resume full-time employment, and how quickly they can do so.

The rolling recession that wiped out the savings and loan industry (S & L’s) and crushed the commercial real estate and apartment sectors didn’t hit Southern California until the second half of 1990, much later than other parts of the country. However, it then persisted far longer here than most everywhere else. The economy didn’t recover until 1997. Conversely, both the Tech Wreck and subsequent 9/11 attack at the beginning of this century had relatively short-lived impacts in Southern California.

It is too early to determine the length and depth of this pandemic’s economic impact. However, you’ll want to keep a watchful eye, assessing the extent of the business failures and resulting job losses that could delay and complicate the path towards our eventual recovery. Consider the likely best, medium and worst-case scenarios for the economic impact of the pandemic.

3rd: Maintain Your Feed Stock

Similarly, you’ll want to assess your liquidity to determine whether you have access to sufficient funds to cover your operating overhead and support any properties that are susceptible to negative cash flow. Only then will you have a handle on your ability to apply the fourth principle.

4th: Expand Your Fences

Prior to his career as a real estate developer, a now close friend of mine, Bob Penner, had spent his first few decades on a Nebraska dairy farm. It’s funny how growing up around all those cows left Bob with some damn good horse sense. While reminiscing about the Great Recession a while back over cold beers, Bob commented that even in down-cycles, you always want to be thinking about moving out your fence lines.

In the past decade, we saw a lot of people who had been successful with small properties such as rental houses jump into apartment investing. As the cycle grew long-in-the-tooth, the tightening market led to thin margins for many apartment acquisitions. More-seasoned investors gravitated towards the sidelines or otherwise reduced their leverage based on their sometimes-painful memories of prior down-cycles. Owners with heavy leverage have now entered the beginning of a massive, real-life stress test. While only some will pass the test, all will obtain an education.

5th: Taming Wild Horses For Your Herd

If we can’t get our population back to work this summer, then delinquent rents will lead to delinquent apartment mortgages. At the end of this rodeo, we could be left with the real estate equivalent of a big hot mess of wild broncos out in the middle of the corral.

In 1991 – 1992, failing S & L’s and eventually the Resolution Trust Corporation (RTC,) a Federal agency formed to liquidate the S & L’s, began to foreclose on apartments and commercial properties. The collapsing prices didn’t stabilize until enough buyers re-entered the market to restore some semblance of equilibrium.

If this current rodeo drags out for long, then similar to the 1990’s, it will eventually require a cohort of knowledgeable, financially sound yet risk-tolerant investors to re-enter the market. These are the players who would then figuratively climb into the corral to restore order to the real estate market, at prices that can be justified under the prevailing economic conditions.

I’m inviting any bronco riders who think they’ll have the fortitude and resources to enter that corral and tame wild horses to throw their hat into the ring. In addition, my team at Voit Real Estate stands ready to assist you in keeping your own horses under control. You know where to find me.

I want you to make a prediction.

Randy, so you want to hold my feet to the fire with a prediction? Being a fellow real estate economics aficionado, you’ll understand my technical jargon here . . . Unless you’re part of the clean-up crew, this down-cycle is really gonna suck.

More specifically, the leverage that was so beneficial in the upcycle has already been transformed into a major liability. Nonetheless, we shouldn’t allow the current doom & gloom to obscure the fact that properties will begin to gravitate from weak to strong hands.