The sale of the Luther View Apartments, while unique, provides multiple lessons for apartment investors about valuation and marketing strategies.

Part 1 – “Well, I guess it’s a bummer to be you today!”

By Robert Vallera CCIM

• Keeping senior citizens off the streets

• Against the odds, the hard truth snatches success from the jaws of failure

• Leveraging the expert use of PR to a client’s benefit

“You want to do what? That will cost you millions!”

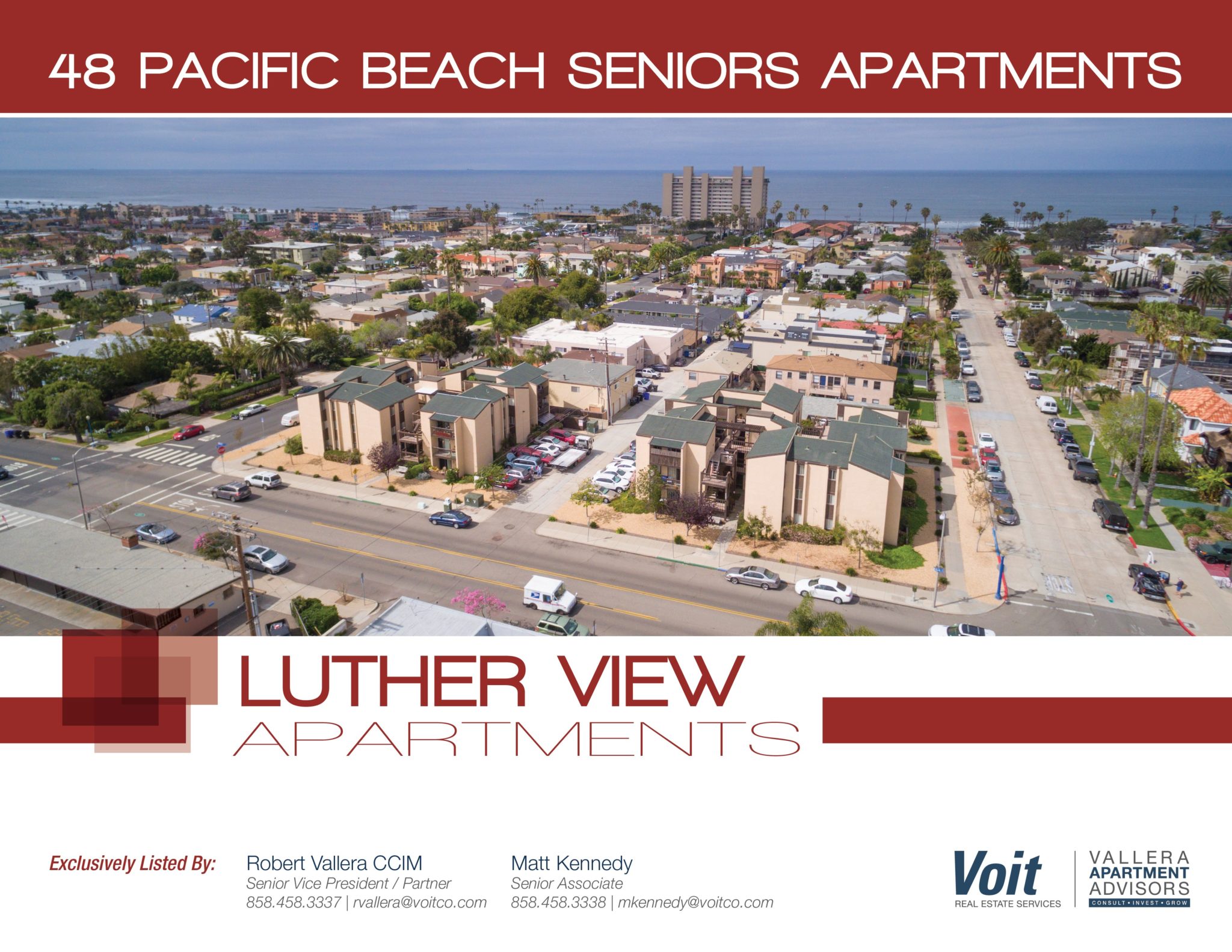

That was my initial reaction to a group that was willing to leave millions of dollars on the table in the sale of 48 senior apartments located only three blocks from the ocean in Pacific Beach, CA.

Normally, our mission as a listing broker is to maximize our client’s return on their investment. However, the seller, Christ Lutheran Church (CLC) had another plan. First and foremost, they wanted to ensure that the 48 senior citizens in their Luther View Apartments would continue to enjoy affordable, below-market rents and not be displaced.

Most of those residents were paying roughly 1/3rd of the $1,650 current market rent. How could my team complete such a sale without discounting the value of the building by 2/3rds? This was going to be interesting.

Christ Lutheran Church (CLC) initially interviewed five brokerage teams. As we made our presentation to their property committee, we explained that severely restricting the property’s future income potential meant that conventional apartment sales comps were irrelevant to Luther View’s valuation. The property was worth dramatically less than the prices suggested by our brokerage competition. I acknowledged that it was rare for the broker presenting the lowest valuation to secure the listing. The church pastor Dave Nagler later admitted his immediate thought was, “Well, I guess it’s a bummer to be you today!”

Adding Value Through Financial Modelling

We wrapped up our presentation by inviting committee members to meet with us and review an analysis of the property valuation from a buyer’s perspective. To make a very long story short, we eventually won the account, helping CLC modify the future rent restrictions to improve the sales price while continuing to honor their mission to maintain affordable housing in Pacific Beach. Their selection of John Boyle as their attorney certainly helped. A fellow CCIM, John fully understood our investment analysis and was a true asset in the process.

A breakthrough in the valuation came when CLC agreed that any vacancies could be re-rented at substantially higher rents providing the amount conforms to HUD’s low-income rent limit. This allowed us to model a gradual, slightly unpredictable but substantial increase in revenues over time, markedly increasing the property value. Our valuation increased further when the seller agreed to carry-back a long-term first trust deed, starting at a below-market interest rate for the first five years.

Man Bites Dog

Launching our marketing campaign, my first call was to a reporter that I know at The San Diego Union-Tribune. “Phil, I have a man-bites-dog story for you,” journalism parlance for an unusual story destined to attract eyeballs.

Phillip Molnar has documented numerous tales of woe about San Diego’s chronic housing shortage, including a recent article about tenants getting priced out of the local apartment market. His next story was destined to have a different, happy ending. The launch of our marketing campaign for the apartments was timed to coincide with what became a front-page article about our new listing in the Union-Tribune.

Creating A Road Map For Prospective Buyers

Our next challenge was creating an offering memorandum that carefully explained the seller’s intentions and required rent restrictions, including an operating proforma robust enough to survive a sophisticated buyer’s due-diligence.

The asking price was set at almost $200,000 per unit for small, one-bedroom units. Would anyone pay such a price if the offering required a 30-year seller-imposed rent restrictions limited to HUD low-income guidelines? We’ll answer that big question in our next post.

Leave a Reply